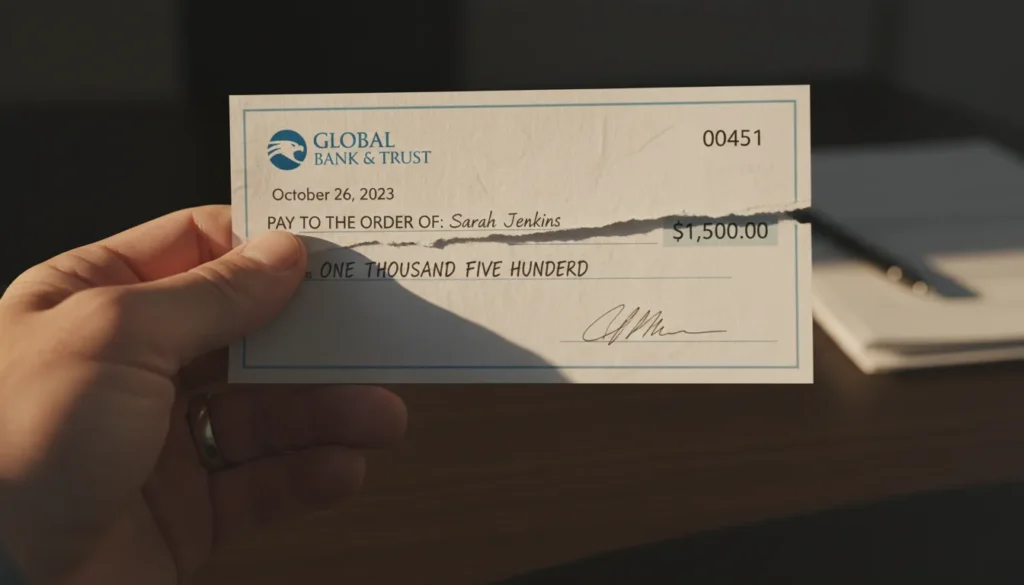

As a bank customer, you may sometimes find yourself with a torn or damaged check in your possession. The natural question that arises is – can a torn cheque be accepted for deposit? The answer is not a simple yes or no, as there are several factors to consider.

The Risks of Depositing a Torn Cheque

Depositing a torn check can be a risky proposition. The tear could indicate that the check has been tampered with, potentially raising fraud concerns for the bank. Additionally, a torn check may not be readable by the bank’s automated check processing equipment, leading to delays or even rejection of the deposit.

Bank Policies on Torn Checks

Most banks have specific policies regarding the acceptance of torn or damaged checks. Some banks may be willing to accept a torn check, but they may require additional verification or even a replacement check to be issued. Other banks may outright refuse to accept a torn check, citing the potential for fraud or processing issues.

It’s important to note that even if a bank does accept a torn check, there may be additional fees or processing time associated with the transaction. This can be frustrating for the customer, but it’s a necessary precaution to protect the integrity of the banking system.

Key Takeaways

Proper Handling of Checks

To avoid the hassle of dealing with a torn or damaged check, it’s best to take care when handling your checks. [Read our guide on properly folding a check](https://mykitchenincome.com/can-you-fold-a-check/) to ensure that your checks remain in pristine condition.

Conclusion

In summary, while a torn cheque can potentially be accepted by a bank, it’s generally not recommended. The risks of fraud, processing delays, and additional fees make it a less-than-ideal situation for the customer. The best course of action is to handle your checks with care and avoid any potential damage or tears in the first place. If you do end up with a torn check, it’s best to contact your bank and inquire about their specific policies before attempting to deposit it.

Advertisement