Mastering the MICR Line: The Secret to Smooth Check Processing

Have you ever wondered what that mysterious string of numbers and symbols at the bottom of your check is all about? That’s the MICR (Magnetic Ink Character Recognition) line, and it’s a crucial component in the world of check processing.

The MICR line is a series of digits and encoded information printed on the bottom of a check using magnetic ink. This special ink can be read by machines, enabling efficient and automated processing of checks. Here’s why the MICR line is so important:

Machine-Readability for Streamlined Processing

The MICR line allows checks to be processed quickly and accurately by machines, rather than relying on manual data entry. This improves efficiency, reduces errors, and speeds up the overall check clearing process.

As we discussed in our previous post, [Can You Deposit a Folded Check? 4 Tips to Avoid Trouble](https://mykitchenincome.com/can-you-deposit-a-folded-check-4-tips-to-avoid-trouble/), the MICR line is essential for ensuring that checks can be scanned and processed correctly, even if they are folded or crumpled.

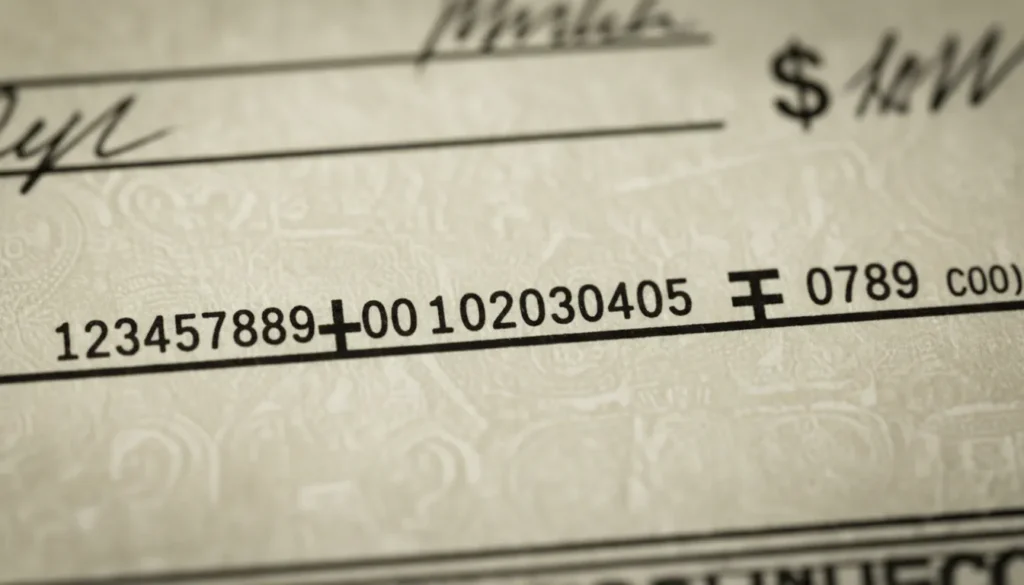

Key Components of the MICR Line

The MICR line typically contains the following information:

1. Routing Number: This nine-digit number identifies the financial institution where the check was issued.

2. Account Number: This variable-length number represents the specific account from which the check was drawn.

3. Check Number: This number corresponds to the unique identifier for the individual check.

By encoding this critical information in a machine-readable format, the MICR line enables banks and financial institutions to efficiently process checks, track transactions, and maintain accurate account records.

The Importance of MICR in the Digital Age

In the era of mobile banking and remote deposit capture, the MICR line has become even more crucial. When you deposit a check using your smartphone’s camera, the mobile app relies on the MICR line to accurately identify the account and routing information, ensuring the deposit is credited to the right place.

So, the next time you look at the bottom of a check, take a moment to appreciate the importance of the MICR line and the role it plays in the smooth processing of your financial transactions.

If you’d like to learn more about the folding and handling of checks, be sure to check out our guide: [Can You Fold a Check?3 Go wrong easy solutions](https://mykitchenincome.com/can-you-fold-a-check/).

Key Takeaways

Advertisement