Actuaries are among the highest-paid professionals in finance and risk, with strong actuary earnings from entry level through to senior leadership roles. Whether you’re a career switcher or a student exploring high-income analytical careers, understanding the earning potential of actuaries is crucial.

In this comprehensive guide, we’ll dive into the latest 2026 salary data for actuaries in the UK, US, and other top markets. From entry-level graduate roles to chief actuary positions, we’ll cover the key factors driving actuary earnings and provide practical tips to maximize your income potential.

Global Actuary Salary Calculator 2026

What Does an Actuary Do?

Actuaries use mathematics, statistics, and financial theory to evaluate the financial costs of risk and uncertainty for insurance, pensions, investments, and other sectors. Their core responsibilities include:

– Analysing data to estimate the probability and cost of future events (death, illness, claims, defaults)

– Designing and pricing insurance policies, pension schemes, and risk-transfer products

– Advising businesses and governments on risk management, capital requirements, and long-term financial planning

How Much Do Actuaries Earn? (Quick Snapshot)

Actuary earnings vary by country, experience, exams passed, and industry, but pay is generally high compared to many other analytical careers.

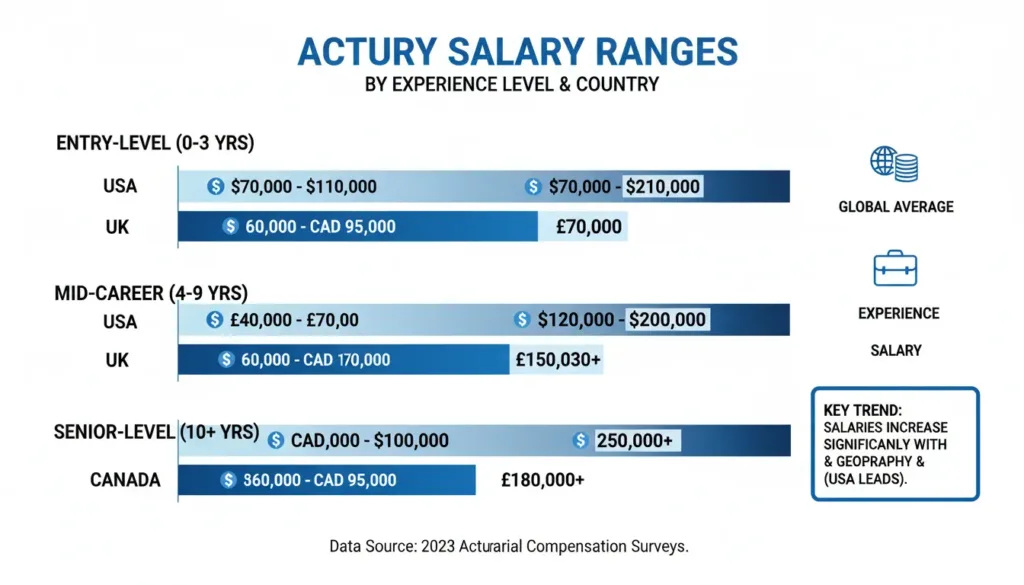

Actuary Salary Progression By Career Stage

Actuary earnings usually grow quickly in the first 5-10 years as you pass exams and gain specialized experience.

– Graduate / Trainee actuary: Often £30,000–£40,000 in the UK, $65,000–$85,000 in the US.

– Recently qualified actuary: Frequently £60,000–£70,000 in the UK, $120,000–$160,000 in the US.

– Senior actuary / manager: Six-figure packages are common in major markets, and chief actuaries can exceed $170,000–$250,000+ in the US.

Actuary Earnings in the UK

The UK is a mature actuarial market with clear pay bands for students, analysts, and qualified actuaries.

– Graduate actuaries often start around £35,000–£39,000 depending on sector and region.

– Typical UK actuaries earn total compensation between about £35,000 and £174,000 including bonuses.

– Roles such as Chief Actuary, Director, and Chief Risk Officer can exceed £180,000–£220,000 at large employers.

Actuary Earnings in the US

The US offers some of the highest actuarial salaries globally, especially in consulting, reinsurance, and property-casualty insurance.

– The average actuary salary is around $104,000–$132,000 per year depending on dataset and methodology.

– Entry-level actuaries typically earn $65,000–$85,000, with higher pay in major cities and specialized lines.

– Fully qualified actuaries with several years’ experience often earn $120,000–$160,000, rising above $170,000 at senior levels.

Factors That Affect Actuary Earnings

Several variables influence how much an actuary can earn over their career:

– Qualifications and exams: Passing professional exams (e.g., IFoA, SOA, CAS) unlocks large salary jumps and exam bonuses.

– Specialism: Property-casualty, reinsurance, and investment-focused actuaries often earn more than some traditional life or pensions roles.

– Location: High-cost cities and financial hubs pay significantly more than smaller markets or government roles.

– Experience and seniority: Moving from student to manager, director, or chief actuary adds substantial compensation, including bonuses and stock.

– Employer type: Global insurers, banks, and consulting firms often have higher pay bands than small mutuals or non-profits.

Benefits and Bonuses

Beyond base salary, actuaries typically receive strong benefits and performance-linked bonuses.

– Exam bonuses of roughly £1,000–£3,000 or similar amounts per passed exam are common in early career stages.

– Annual bonuses and profit-sharing can significantly increase total compensation at mid-senior levels.

– Other benefits may include pensions, health insurance, study support, paid study leave, and flexible working.

Tips To Increase Your Actuary Earnings

Strategic career choices can accelerate your earnings trajectory as an actuary.

– Pass exams quickly and consistently to reach associate/fellow status early in your career.

– Consider high-demand niches such as property-casualty, catastrophe modelling, reinsurance, or data science-heavy roles.

– Gain experience in different practice areas or move into consulting for exposure to varied projects and clients.

– Relocate to markets or cities where salaries are higher relative to cost of living if lifestyle allows.

– Develop soft skills (communication, leadership, stakeholder management) to move into management and chief actuary tracks.

Common FAQs About Actuary Earnings

1. Is being an actuary a high-paying job?

Yes, actuarial roles are widely regarded as high-paying, with many actuaries earning well above national averages in markets like the US and UK.

2. How much does a new actuary make?

Entry-level actuaries usually earn around £30,000–£40,000 in the UK and $65,000–$85,000 in the US, depending on sector and location.

3. How quickly can actuary salaries grow?

Earnings tend to rise quickly in the first decade, with many actuaries roughly doubling their starting salary once qualified and experienced.

4. Do actuaries get bonuses for exams?

Many employers pay exam bonuses, often in the range of £1,000–£3,000 per passed exam or similar amounts in local currency.

5. Which countries pay actuaries the most?

Top-paying markets include Switzerland, the United States, Ireland, and Japan, where average actuary salaries can exceed $170,000–$200,000 at senior levels.

6. Are consulting actuaries paid more?

Consulting and reinsurance roles often pay more than some traditional in-house positions, especially for actuaries who generate revenue and manage client relationships.

7. Is the cost of living important when comparing actuary earnings?

Yes, high nominal salaries in some cities can be offset by high living costs, so actuaries often look at after-tax income and quality of life when evaluating offers.

8. Do actuaries earn more than other finance roles?

Actuaries typically earn more than many general finance or analyst roles but may earn less than some investment bankers or hedge fund professionals at the very top end.