Introduction

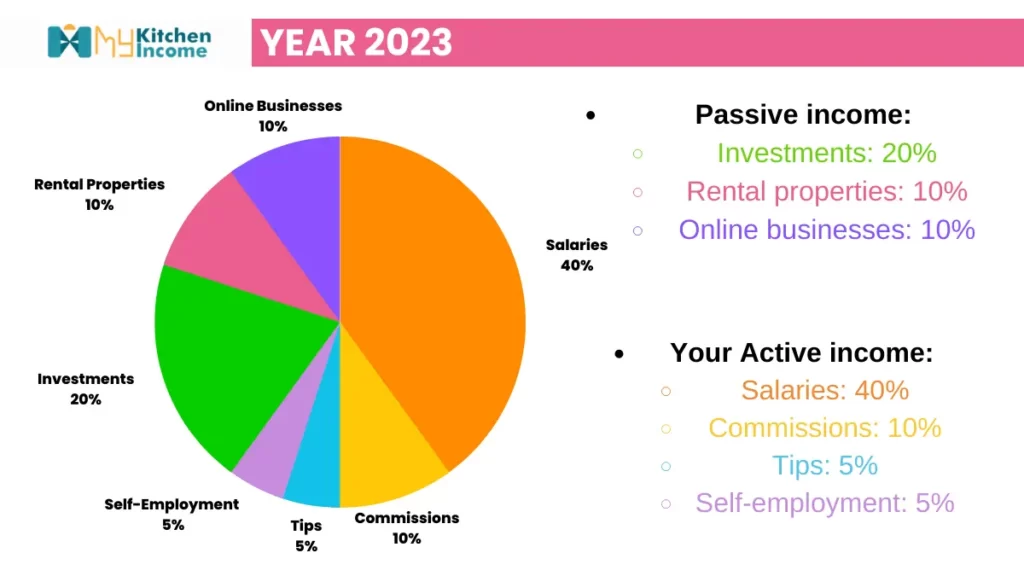

In this article, we will delve into the concepts of passive income vs active income, explore their characteristics, compare their differences, and discuss strategies to leverage both. When it comes to financial stability and independence, understanding the difference between passive income and active income is crucial. These two income streams play significant roles in shaping our financial lives, and each offers unique advantages and disadvantages. By the end, you will have a clearer understanding of these income streams and be better equipped to make informed decisions regarding your financial future.

What is Active Income?

Definition and Examples

Active income refers to the money earned through actively participating in work or providing services. It is the traditional form of income that most people are familiar with. Examples of active income include salaries, wages, tips, and commissions.

Characteristics of Active Income

Direct involvement: Active income requires direct effort and time investment from the earner. It often involves exchanging time and skills for compensation.

Linear correlation: The amount of active income earned is usually directly proportional to the time and effort invested. In other words, the more you work, the more you earn.

Immediate earnings: Active income provides immediate financial rewards, as earnings are typically received on a regular basis, such as weekly or monthly.

Advantages and Disadvantages

Stability and predictability: Active income offers a stable and predictable cash flow, making it easier to budget and meet immediate financial needs.

Skill development and career growth: Active income provides opportunities for skill development and career advancement, leading to higher earning potential in the long run.

Social benefits: Active income often comes with additional benefits like health insurance, retirement plans, and paid time off, contributing to overall financial security.

Disadvantages of Active Income

Limited time availability: Active income is limited by the number of hours one can work in a day. This can hinder work-life balance and limit the potential for earning additional income.

Dependency on employment: Active income is tied to employment, making individuals vulnerable to economic fluctuations, job loss, and limited control over their income.

Lack of scalability: Active income is usually limited in scalability since earning potential is directly related to personal effort and time investment.

Strategies for Maximizing Active Income

To maximize active income, consider the following strategies:

1- Education and skill development: Continuously invest in enhancing your skills and knowledge to increase your value in the job market and potentially earn higher wages or promotions.

2- Career advancement and promotion: Seek opportunities for career growth within your field or industry. This can involve taking on leadership roles, pursuing advanced certifications, or seeking out higher-paying positions.

What is Passive Income?

Definition and Examples

Passive income refers to the earnings generated from assets or investments that require minimal effort to maintain or manage. Unlike active income, passive income allows for more freedom and flexibility as it is not directly tied to trading time for money. Examples of passive income include rental properties, dividend stocks, interest income, and online businesses.

Characteristics of Passive Income

Limited active involvement: Passive income requires less direct involvement once the initial setup or investment is made. It allows for the potential of earning income while doing other activities or even when you’re not actively working.

Potential for scalability: Passive income has the potential to scale significantly since it is not directly tied to the number of hours worked.

Long-term benefits: Passive income can provide long-term financial security and the opportunity to build wealth over time.

Advantages and Disadvantages

Financial freedom and flexibility: Passive income allows for more freedom and flexibility in terms of time and lifestyle choices, as it does not require constant active involvement.

Wealth accumulation: Passive income can contribute to long-term wealth accumulation and financial independence by generating income even when you’re not actively working.

Diversification and risk reduction: Having multiple streams of passive income can help diversify your overall income portfolio, reducing the reliance on a single income source.

Disadvantages of Passive Income

- Initial investment and setup: Passive income often requires an initial investment of time, money, or both to set up the income-generating asset or business.

- Market volatility and risk: Certain passive income streams, such as investments, are subject to market fluctuations and risks. It’s essential to assess and manage these risks effectively.

- Delayed returns: Passive income may not provide immediate financial rewards. It often takes time to build and establish passive income streams before they start generating substantial returns.

Strategies for Generating Passive Income

To generate passive income, consider the following strategies:

Investments and dividend earnings: Invest in stocks, bonds, real estate investment trusts (REITs), or other income-generating assets that offer regular dividends or returns.

Real estate and rental income: Acquire rental properties or invest in real estate projects that can generate passive income through rental payments or property appreciation.

Online businesses and affiliate marketing: Establish an online business, create digital products, or engage in affiliate marketing to earn passive income through online sales and advertising.

Key Differences Between Passive and Active Income

Time and Effort Requirements

Active income requires direct time and effort investment, often in the form of a job or work. In contrast, passive income requires an initial investment of time or money but can generate income with minimal ongoing effort.

Scalability and Potential for Growth

Active income is often limited in terms of scalability, as earning potential is tied to personal effort and time investment. Passive income, on the other hand, has greater potential for scalability, allowing for the accumulation of wealth over time.

Level of Control and Flexibility

Active income offers limited control and flexibility, as it often relies on employment and follows a set schedule. Passive income provides more control and flexibility over one’s time and lifestyle choices.

Risk and Security Factors

Active income is subject to employment-related risks such as job loss or economic fluctuations. Passive income carries its own risks, such as market volatility or business performance, but diversification can mitigate these risks to some extent.

Tax Implications and Treatment

Active income is usually subject to higher tax rates, while passive income can have different tax treatments depending on the source. It’s essential to understand the tax implications of each income type to optimize your overall tax strategy.

Making an Informed Decision: Which Income Stream is Right for You?

To determine the right income stream for you, consider the following factors:

- Personal goals and priorities: Evaluate your financial goals, lifestyle preferences, and long-term objectives to align them with the income stream that best suits your needs.

- Individual skills and interests: Assess your skills, knowledge, and interests to identify opportunities for maximizing active income and exploring potential passive income streams.

- Risk tolerance and financial resources: Consider your risk tolerance and available financial resources when deciding how much time and money you can invest in active or passive income ventures.

- Balancing active and passive income: Recognize that active and passive income can complement each other. Finding a balance that suits your circumstances can provide financial stability and diversified income sources.

Table showing the differences between passive income and active income, with examples and estimated earnings for a web developer:

| Type of Income | Description | Examples | Estimated Earnings | Places to Work |

| Passive Income | Income that requires little or no ongoing effort to maintain. | Selling digital products, affiliate marketing, rental properties, etc. | Can range from a few hundred dollars to thousands of dollars per month. | Udemy, DigitalOcean, Amazon Web Services, etc. |

| Active Income | Income that is earned through work or effort. | Freelance web development, full-time web development jobs, etc. | Can range from a few thousand dollars to tens of thousands of dollars per month. | Upwork, LinkedIn, Indeed, etc. |

Here are some additional details about passive income for web developers:

- Selling digital products: This could include anything from website templates and plugins to online courses and ebooks. Once the product is created, it can be sold over and over again, generating a passive income stream.

- Affiliate marketing: This involves promoting other people’s products or services in exchange for a commission on each sale. This can be a great way to earn passive income if you have a large audience or following.

- Rental properties: This is a classic example of passive income. Once you purchase a rental property, you can collect rent from tenants on a monthly basis.

Here are some additional details about active income for web developers:

- Freelance web development: This involves working on web development projects for clients on a contract basis. This can be a great way to earn a high income, but it can also be very demanding.

- Full-time web development jobs: This is the most common way for web developers to earn an income. Full-time web development jobs typically offer a steady salary and benefits, but they may not offer as much flexibility as freelance work.

Conclusion

In conclusion, both passive income and active income play significant roles in our financial lives. Active income offers stability and immediate financial rewards while requiring direct time and effort investment. Passive income, on the other hand, provides flexibility, scalability, and the potential for long-term wealth accumulation. Understanding the key differences between these income streams is crucial for making informed decisions about your financial future. By leveraging both active and passive income, you can achieve financial independence and enjoy a more secure financial position.

FAQs

1. Can I have both active and passive income at the same time?

Yes, many individuals have a combination of active and passive income streams. By diversifying your income sources, you can enjoy the benefits of both.

2. Are there any risks associated with passive income?

Yes, passive income carries certain risks, such as market volatility, business performance, or changes in regulations. However, diversifying your passive income streams can help mitigate these risks.

3. Which is better, active income, or passive income?

The choice between active and passive income depends on your personal goals, preferences, and financial situation. Both income streams have their own advantages and disadvantages, and finding the right balance that suits your circumstances is key.

4. Can passive income completely replace active income?

While it is possible for passive income to replace active income for some individuals, it usually requires significant time, effort, and investment to reach that level. It’s important to set realistic expectations and carefully plan your financial strategy.

5. How can I get started with generating passive income?

To generate passive income, you can explore various avenues such as investments, real estate, online businesses, or even creating digital products. Research and education in your chosen field are crucial to get started on the right path.